Capital gains calculator for home sale transactions

Ad Skip the hassle. As a quick way to find out what youre in for use an online capital gains.

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses

Capital gains and losses are taxed differently from income like.

. Short-term investments held for one year or less are taxed at. Web You may have a capital gain or loss when you sell a capital asset such as real estate stocks or bonds. Web This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset.

The positive gain here is equal to the. Web Our home sale calculator estimates how much money you will make selling your home. Real estate property includes.

Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing. Ad Your Investment Property Search Begins and Ends Here. Web Most single people will fall into the 15 capital gains rate which applies to incomes between 40401 and 445850.

Property Basis Sale of Home etc Stocks Options Splits Traders Mutual. Then in the final column we calculate the gain or loss. Web Illustration of Long Term Capital Gain Tax Calculation.

Ad The Leading Online Publisher of National and State-specific Legal Documents. Single filers with incomes more than 445851. Web Frequently Asked Question Subcategories for Capital Gains Losses and Sale of Home.

Web How long you own a rental property and your taxable income will determine your capital gains tax rate. Web Capital Gains Tax Exclusion. ESTIMATED NET PROCEEDS 269830 Desired selling price 302000 Remaining.

Invest in Silicon Valley Real Estate. Competitive offers from interested buyers are one click away. Find the Right Investment Property In Minutes.

Web The first step in how to calculate long-term capital gains tax is generally to find the difference between what you paid for your asset or property and how much you sold it for. Suppose Amit had invested in debt-oriented mutual funds in April 2016 and the investment amount was Rs. The IRS allows taxpayers to exclude certain capital gains when.

Web These gains are taxed more favorably at 0 15 or 20 percent depending on the amount of gain. Get Access to the Largest Online Library of Legal Forms for Any State. Web This comes from records or statements provided by the brokerage firm.

Web Capital Gains Selling Price Purchase Price 12000 - 10000 2000 Capital gains tax is only paid on realized profits and not on unrealized profits. Enter an Address Start Analyzing. A capital gain represents a profit on the sale of an asset which is taxable.

Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing. Web Calculate your capital gains taxes and average capital gains tax rate for the 2022 tax year. Invest in Silicon Valley Real Estate.

Capital Gains Tax on Sale of Property.

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

A History Of Real Estate Infographic Real Estate Infographic Real Estate Tips Real Estate

Capital Gains Tax Calculator 2022 Casaplorer

Keep A Check On These When Builder Hands Over Your Housing Society Commonfloor Groups Society Investing Property Real Estate

Nyc Home Sale Net Proceeds Calculator Interactive Hauseit

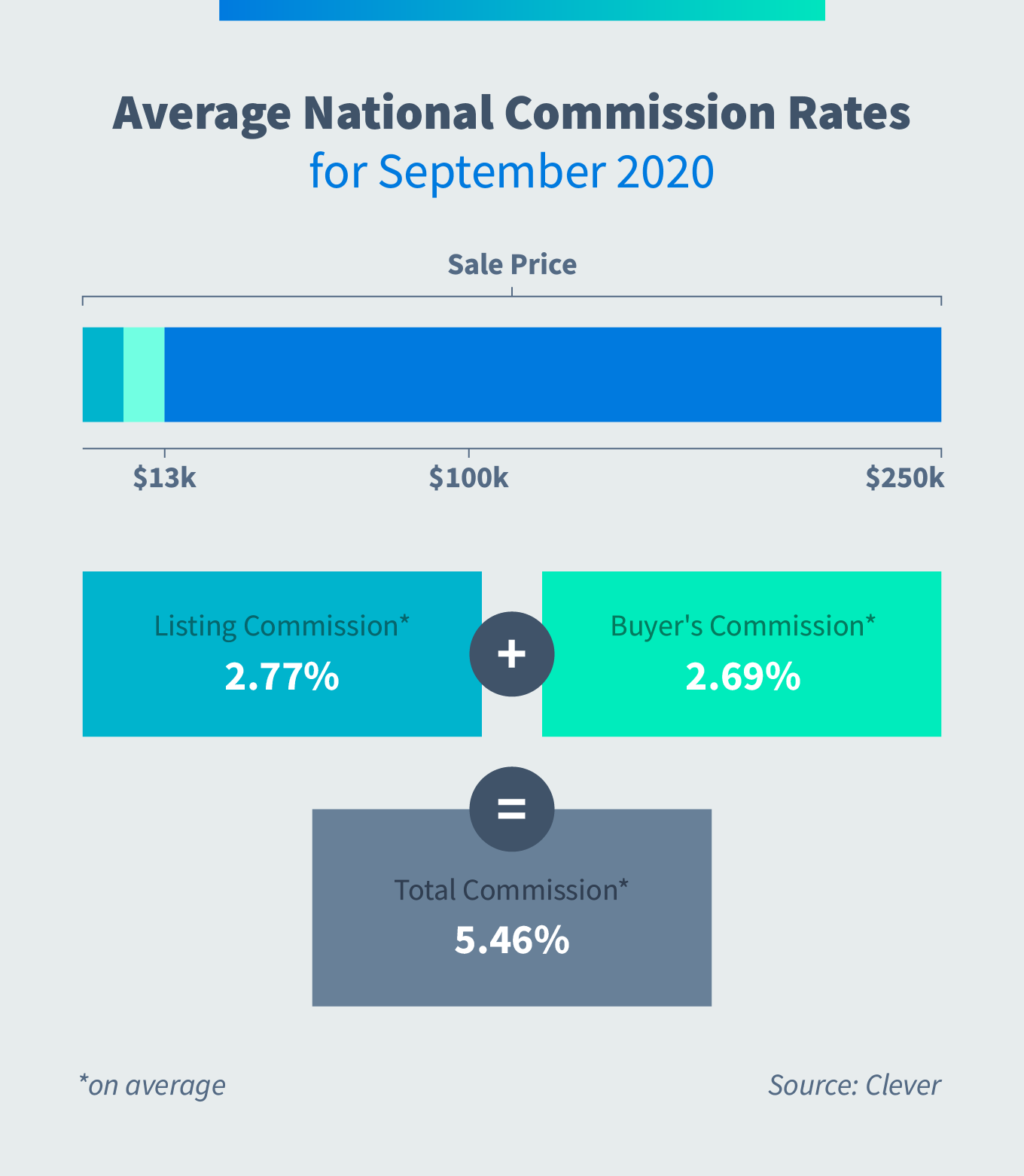

How To Calculate Real Estate Commissions 10 Steps With Pictures

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Nyc Home Sale Net Proceeds Calculator Interactive Hauseit

Capital Gains Tax What Is It When Do You Pay It

Real Estate Capital Gains Tax Calculator For Nyc Interactive Hauseit

Pin On Making Money Opportunities Asap

How To Calculate Real Estate Commissions 10 Steps With Pictures

Return On Equity Roe Calculator For Real Estate Investing Denver Investment Real Estate

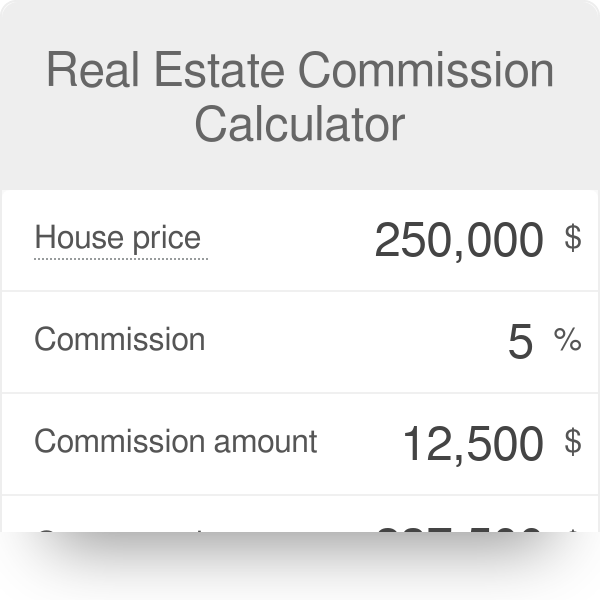

Real Estate Commission Calculator

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Easy Real Estate Commission Calculator Rentspree Blog